Shares in battered biotech Tetraphase Pharmaceuticals (Nasdaq: TTPH) were yesterday’s big winner in US trading, moving up 78% after La Jolla (Nasdaq: LJPC) announced it had submitted a 22M non-binding all-cash proposal to acquire the company, plus an additional 12.5M in Contingent Value Rights.

This offer comes after Tetraphase already agreed to be acquired by AcelRx Pharma (Nasdaq: ACRX) in March of this year. AcelRx offered 14.4M in stock at the time, and also added 12.5M in Contingent Value Rights to the mix.

Every investor loves a bidding war, right? This might explain why Tetraphase shares were aggressively bid up from a $1.35 close on Wednesday to a $2.42 close on Thursday. Intraday shares even traded at $3.50.

However, I’ll argue investors are jumping the gun. The AcelRx offer and the La Jolla offer both represent a value that is much lower than the current share price. Even if either bidder raises its bid, it’s not likely it will come even close to what Tetraphase is currently trading at in the market.

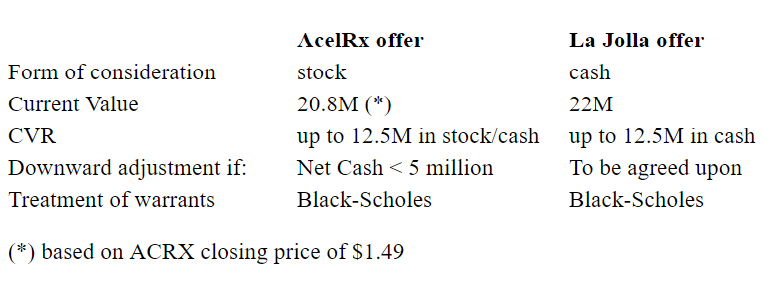

Comparing the bids

As you can see in the table above La Jolla’s offer is slightly better than AcelRx’s offer, but not by much. Because the share price of AcelRx has been performing very well lately the value of its all-stock bid has increased from 14.4M mid-march to 20.8M today. La Jolla’s bid is all-cash though, which is generally considered more valuable than an all-stock offer.

Another slight difference is AcelRx has the right to adjust its bid downwards if Tetraphase has less than 5 million dollars in net cash at the time of closing. Considering Tetraphase had over 26M in cash equivalents per the 31st of March and burns about 15M a quarter that won’t be an issue.

Value per share

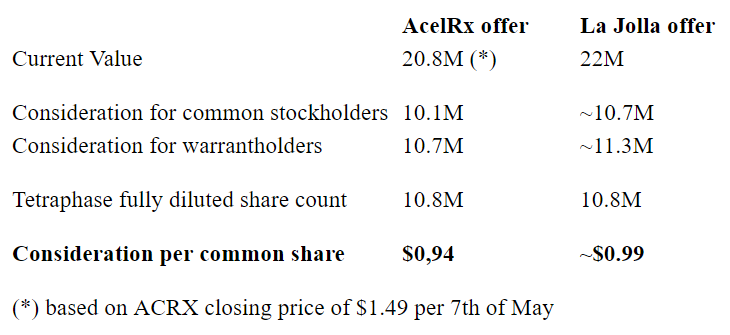

The day-trading crowd went nuts yesterday trading Tetraphase shares as most seemed to assume the 22M bid by La Jolla would be split over the currently outstanding 7.2M shares, adding up to a supposed 3.05$ offer per Tetraphase share. Well, unfortunately, that’s not the case.

First of all, this calculation is wrong with regard to the share count. When the merger closes all outstanding restricted stock units and outstanding pre-funded warrants (warrants with a near-zero exercise price) will be added to the current number of shares outstanding. The Tetraphase share count at time of closing will not be 7.2M, but approximately 10.8M.

Second of all, the calculation is wrong in ignoring all other outstanding warrants. These warrants, when they were issued in 2019 and early 2020, contained a clause they need to be re-purchased at fair value upon “a fundamental transaction” (like, for example, a takeover). Fair value is determined using the Black & Scholes option pricing formula.

In practice, this means any takeover consideration will be split. In case of the AcelRX’s offer, a fixed exchange ratio was agreed for the warrants, which means 48.7% of the merger proceeds go to Tetraphase’s common stockholders, and 51.3% go to the warrant holders.

I can’t think of a reason why this split would be significantly different in La Jolla’s offer, as Tetraphase’s largest shareholder, Armistice Capital, is also the company’s most important warrant holder (as well as having two seats on Tetraphase’s Board of Directors). For La Jolla’s offer to have any chance of success, it would no doubt need to pay the warrant holders a similar amount as AcelRX.

That’s very bad news for Tetraphase’s common shareholders, as this essentially means whatever is on the table right now, under whatever bid, doesn’t add up to more than 1$ per share. Considering Tetraphase stock is currently trading at $2.42, the market doesn’t seem to realize this.

Contingent Value Rights

That still leaves the Contingent Value Rights. The CVR’s in both AcelRx and La Jolla’s offers are identical and add up to 12.5 million dollars in future payments, or $1.16 per share.

As a reminder, Contingent Value Rights pay out certain amounts of money to their holders if certain pre-agreed milestones are reached. If they are not reached, the CVR’s expire worthless.

In this case, the CVR’s would entitle Tetraphase’s shareholders to potential payments if Tetraphase’s main FDA (and in most other parts of the world) approved drug XERAVA reaches a certain amount of sales in or before a certain year.

- 2.5M ($0.23 per share) in payments if annual Net Sales of XERAVA reach 20M in or before 2021;

- 4.5M ($0.42 per share) in payments if annual Net Sales of XERAVA reach 35M in or before 2024;

- 5.5M ($0.51 per share) in payments if annual Net Sales of XERAVA reach 55M in or before 2024;

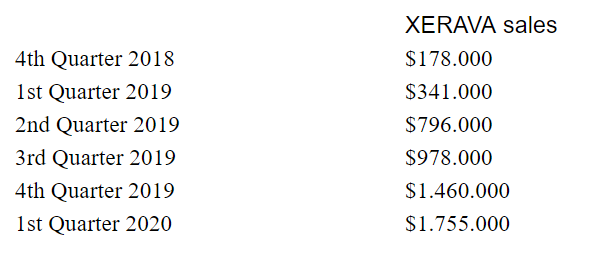

XERAVA, a treatment for complicated intra-abdominal infections and Tetraphase’s only revenue-generating asset, was launched in the 4th Quarter of 2018. I’ve attached a table showing its sales since then.

Obviously, while sales of XERAVA are indeed growing, the current growth trajectory is not what’s needed to reach any of the milestones that would trigger a CVR payout. But then perhaps one might argue it’s a new drug which takes time to gain market acceptance, and it might do better when managed by a bigger company with more resources to spend on it (either AcelRx or La Jolla).

Investment banker Janney Montgomery Scott assigns a 6M to 6.8M present value to the CVR’s, so let’s be generous and go with that. All in all, this adds up about $0.60 per share in fair value for Tetraphase shareholders on top of the initial merger consideration.

So what now?

The Tetraphase Board made clear they have not yet determined whether the La Jolla’s offer is “superior” to the already agreed deal with AcelRx, and are at this point still recommending AcelRx’s bid to their shareholders.

Also, La Jolla’s offer is still non-binding, although the company believes it can complete due diligence by next Monday after which it might be able to deliver a definitive offer.

If the Tetraphase Board does not decide to switch sides, AcelRx seems certain to win this bidding war. For the deal to go through, a simple majority of the Tetraphase stock needs to be voted in favor of an already scheduled special shareholders meeting on the 8th of June. 31% of the votes have already been locked up in favor of the merger.

If the Tetraphase Board eventually does decide to switch sides and go with La Jolla, Tetraphase owes AcelRx a $810.000 termination fee, which further decreases the current valuation gap between the two bids.

According to news site Benzinga, H.C. Wainwright analyst Ed Arce wrote in a research note he does not believe La Jolla’s offer is “compelling to Tetraphase to pull the company away from the current proposed transaction”. I tend to agree. It certainly doesn’t help La Jolla waited until the very last minute to submit its bid.

To really get into the mix La Jolla will probably have to raise its offer (or the AcelRx’s share price must fall, thereby decreasing the value of AcelRx’s offer). And perhaps La Jolla will; otherwise, why would La Jolla join this fight in the ninth inning: they themselves must know it’s unlikely they will have success with their current offer.

Sadly though, in the end for the current Tetraphase shareholder it won’t really matter all that much; he/she would likely still be better off selling at the market right now. Even if La Jolla does raise its bid from 22M to, for example, a very optimistic 30M, its value to common shareholders would only add up to about $1.35 per share plus whatever you think the CVR is worth. As I write this article this is still a long way from where the Tetraphase shares are trading at.