Posera, a Canadian listed global provider of software solutions for the hospitality industry, is being acquired by PayFacto, a provider of payment solutions.

Posera is a nano-cap with a market capitalization of about 14 million dollars, which trades in Canada under ticker TSE:PAY. It last traded at $0.12. Although it also technically has a listing in the US (PINK: PRRSF), it virtually never trades there.

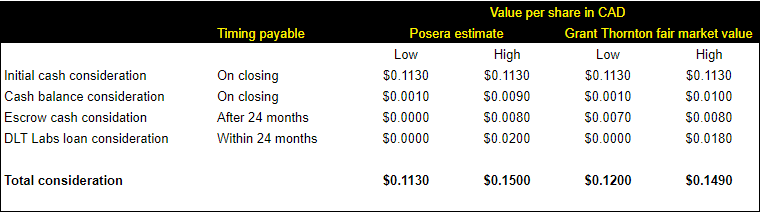

PayFacto’s takeover bid is made up of four different components, which makes this deal a bit more complex than usual. In this article, I’ll briefly go over the four components, and try to make an educated guess what those components are worth.

Component 1: Initial cash consideration

Let’s start with the easy part. Posera shareholders are offered $0.1127 per share in initial cash consideration.

Component 2: Cash balance

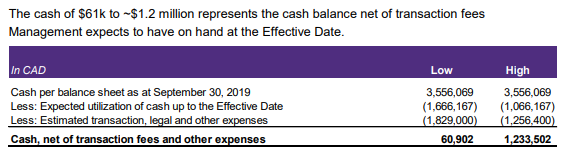

On top of this Posera shareholders will also receive consideration based on Posera’s cash balance at the time of closing. Posera currently (very broadly) estimates an amount per share between $0.0005 and $0.0086.

It’s difficult to come up with any sort of unique insight here. Over the last four quarters Posera burnt through about 900.000 dollars per quarter on average, but over the last quarter cash burn was the highest: over 1.2 million dollars. Posera’s CEO said the company has been taking steps to minimize spending (including closing down the London office, which Posera expects will reduce costs in the fourth and first quarter), but eventually, it’s very difficult to get any visibility, let alone with regards to expenses related to transaction-related legal fees.

In my experience, more often than not in these kinds of situations, companies very rarely spend all the way up to the worst-case scenario, unless a takeover is unexpectedly delayed or more complicated than originally anticipated. No guarantees though.

Component 3: Escrow release

As part of the transaction, Posera will deposit one million dollars into an escrow account for a period of 24 months to satisfy any tax claims as a result of the sale of two previous businesses in 2016 and 2017. After two years what’s left in the escrow account will be distributed to Posera shareholders, up to $0.0083 per share.

Accounting firm Grant Thornton, in its independent fairness opinion, believes the likelihood of a significant claim being made against this escrow account is very low. Their fair value analysis suggests they are estimating potential claims between 50.000$ and 150.000$.

Component 4: Pro-rata payment on loan collection

The fourth and final part of the consideration Posera shareholders will potentially receive is a pro-rata payment on any funds that are collected from an outstanding loan with a principal balance of 2.44 million dollars to DLT Labs.

DLT Labs, a company specializing in the implementation of blockchain technology, was a related party at the time the loan agreement was signed, as its CEO is the former Executive Chairman of Posera.

This loan, which honestly to me looks quite dodgy from the get-go, is now in trouble. It was originally due in October 2018, and Posera was forced to write down the theoretical value of the loan during the course of 2018 and 2019, as default has become more probable. Per Posera’s latest financial statement, the DLT loan is on the books at a little over 1 million dollars (although, of course, Posera is still seeking collection of the full amount outstanding).

Posera emphasizes the loan is secured by certain “assets” of the borrower, but I have not been able to track down what those assets are. Also, I have not been able to find any meaningful financial information on privately held DLT Labs. According to their website, DLT Labs is currently still blogging away, sending out press releases and appear to be hiring new staff though.

If the loan is collected in full within 24 months, Posera shareholders will receive an additional $0.0201 per share. If the loan isn’t collected at all within this time period, Posera shareholders will receive nothing (and any scenario in between on a pro-rata basis).

It’s not clear to me from the arrangement if PayFacto actually has an incentive (or obligation) to attempt to collect this late loan, or liquidate the secured assets, within the next twenty-four months, as they would then be forced to hand over the proceeds to Posera shareholders. I’ve asked Posera for specifics about this arrangement, but have not heard back yet. I’ll update this article if I do.

All in all, without any additional information, the likelihood of Posera shareholders being paid on this part of PayFacto’s bid, seems rather small to me. A creditor with an apparent lack of funds, and a debtor with an apparent lack of incentive to collect: not a great combo. This component of the bid seems like a nice lottery ticket, but only as long as you get it for free.

Summary:

Transaction risk

Posera shareholders will vote on PayFacto’s takeover bid on the 22nd of January. To be effective 66 2/3% of the votes cast must be in favor (as well as a majority of the minority vote). As non-votes are not taken into consideration, reaching these kinds of thresholds is almost never an issue unless there’s very strong shareholder opposition (which there isn’t).

In this case, as far as I could find, most of the Posera shareholder base appears to be retail, except for a few larger funds owning 2% stakes. The offer by PayFacto was made at a very significant (87%) premium to Posera’s share price and Posera’s proxy statement revealed no other bidding parties coming forward during negotiations. Also, PayFacto’s offer is well above the “fair value” assigned by the accountants of Grant Thornton in an independent analysis, and Posera hasn’t been performing well these last few years. Posera’s directors own up to 9% of the company and have all signed an agreement to vote in favor of the transaction.

Apart from the shareholder vote, PayFacto’s bid is also conditional on not more than 10% of Posera’s shareholders exercising Dissent Rights. Again, considering Posera’s shareholders appear to be mostly retail, this seems highly unlikely to be an issue. Other conditions include court approval and regulatory approval, which all seem to be not applicable or a formality for a deal of this size.

While there is significant downside to Posera’s share price if this deal somehow breaks, the likelihood of this happening seems very low to me.

Assuming shareholder approval, PayFacto expects to complete this transaction very quickly, in late January.

Conclusion

As I’m writing this article Posera stock is trading $0.115 bid and $0.12 ask for days now, with very little action. Taking into account this Canadian stock trades with a half-a-cent tick size, execution price is – very – important.

At $0.115, I think the stock is a definite buy, but unfortunately, there isn’t much action happening at this price level.

At $0.12, I believe Posera is a decent investment that offers an OK non-correlated return. Assuming the bid is completed successfully you will get back 94% of your investment within a month, even in a worst-case cash scenario. Considering this deal seems to be proceeding on schedule thus far, and assuming Posera keeps spending under control these last few months, the additional consideration dependent on its cash balance should go a long way to making anyone buying at this price level whole right away.

With virtually all of your money back in your wallet to invest and generate returns elsewhere in the market, this creates an almost free upside on whatever proceeds remain from the escrow account in two years. And it seems reasonable to expect an additional pay-out here of at least another $0.007 per share.

To top things off, as a kicker, you have further bonus upside on whatever, if ever, is collected on the DLT Loan over the next two years, up to another $0.02 per share.

From a share price of $0.125 upwards, the Posera investment case becomes unattractive very fast. With a larger percentage of your invested capital tied up for the next two years to get to an attractive rate of return, you would have to start attributing positive value to the DLT Loan component, which I would not feel comfortable with.

Note: all dollars mentioned in this article are Canadian Dollars.

Update 23rd of January: Posera shareholders have approved the takeover.