Summary

- Realm Therapeutics has, pending shareholder approval, agreed to be acquired by ESSA Pharma.

- ESSA’s unattractive bid is in illiquid stock and strongly undervalues Realm’s cash position.

- Realm’s board and large shareholders clearly have a conflict of interest.

- It’s up to Realm’s small minority shareholders to block this deal and prevent this cash grab from happening.

- The shareholder vote is planned for the 24th of June. Vote your shares!

Introduction

On the 16th of May, Realm Therapeutics (RLM) announced it had reached agreement to be acquired in an all-stock-deal by ESSA Pharma (EPIX)/(TSEV: EPI).

In this article, I’ll explain why, as a Realm shareholder, I believe this transaction is an extremely bad deal, and why I will vote against it during the upcoming shareholders’ vote planned for the 24th of June.

I’ll take a closer look at the shareholder base of Realm Therapeutics. I’ll explain why there are several large shareholders backing this deal even though it’s is so clearly value destructive.

Also, I’ll show how another large shareholder that didn’t back the deal appears to have been cashed out as recently as two weeks ago at a price far, far superior to what us little shareholders are getting.

And finally, I’ll explore if there’s any realistic possibility for this transaction to be voted down.

The company

Realm Therapeutics is a failed biotech, that, after selling its last remaining assets in March of this year, is in fact not much more than a bag of cash. On the 31st of March, Realm had 27.7 million dollars in cash. At the time of closing of the ESSA-transaction, Realm expects this amount has dwindled to approximately 20.5 million dollars, which equals about $4.40 per Realm ADS.

ESSA’s offer

ESSA is offering Realm shareholders approximately 1.45 ESSA common share for every 1 Realm ADS. The exact exchange ratio will be determined based on Realm’s definitive cash position.

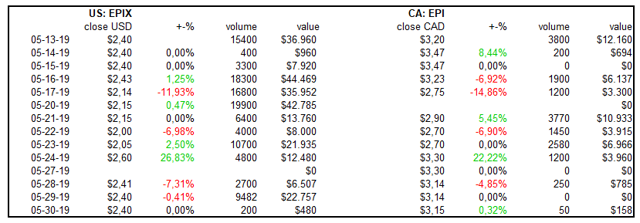

At today’s closing price, ESSA’s bid is essentially worth about $3.48 per Realm ADS. Other than that’s significantly below cash value, this number fluctuates wildly day by day. ESSA’s stock, traded in both the US and Canada, is terribly illiquid. As you can see below, a few thousand shares traded over an entire trading day are able to send the share price of either listing up or down ten percent.

One can only imagine what will happen to the ESSA share price if this takeover is eventually completed. With approximately seven million new shares being issued, Realm shareholders who will want to sell their newly issued stock will most likely find virtually no bid at all.

So, in a nutshell, the Realm board has accepted to sell out the cash position of the company for less than 80 cents on the dollar, not in cash, but in virtually untradeable, illiquid stock.

It’s one of the most blatant examples of minority shareholders being ripped off I can remember.

Scheme of Arrangement

As Realm Therapeutics is still a UK company, the acquisition is to be effected by means of a “Scheme of Arrangement” under UK law. Things under such a scheme are a bit different than the average takeover in the United States, so a quick explanation is in order.

A Scheme of Arrangement needs the approval of the shareholders of the company being acquired as well as the UK High Court.

Shareholder approval constitutes of:

1. approval from a majority in number of shareholders who are voting at the Shareholders Meeting (the so-called “headcount” requirement”)

2. approval from 75% of the votes which are voted at the meeting

The “headcount” requirement

On the surface, the “headcount” requirement (which is a rather unusual requirement) looks like an interesting way for minority shareholders to block a transaction, as every shareholder, regardless of the size of their holdings, has one vote. However, I believe there’s a catch in this case.

Originally, Realm ordinary shares were being traded at the AIM, a sub-market of the London Stock Exchange. From July of 2018, Realm was also approvedfor trading on the Nasdaq in the form of American Depository Shares (ADS).

The company actively encouraged shareholders to convert their UK ordinary shares into ADSs, by offering a six-month window in which shareholders were allowed to convert their holdings for free. On the 26th of March of this year, Realm terminated its UK listing altogether, which meant anyone that still owned ordinary shares at this point had to convert to ADSs to still be able to trade.

It seems likely virtually every Realm shareholder will own ADSs now and not ordinary shares. ADSs are different from ordinary shares; they are issued by a depositary bank in agreement with the issuing foreign company. In case of a vote being brought to a shareholders meeting, shareholders don’t vote the ADSs directly but instruct the depositary bank how to vote on their behalf.

I’m quite certain and I’ve found several sources to back this up (for example here), the vote of the depositary counts as one vote for the “headcount” requirement. So, while you might have hundreds of individual disgruntled ADS holders voting against a proposal, only one actual voter registers, the depositary itself. This technicality would obviously completely hollow out the headcount requirement.

I’m not 100% sure about this, so I have gotten in touch with Citibank, the depositary of Realm ADSs, to have the above confirmed. They are looking into it but did not provide a definitive answer in time for the publication of this article. I’ll update when they do respond. Any readers that know more, please also feel free to share your knowledge.

The “75% voting” requirement

This leaves the 75% voting requirement, which is a bit more straightforward to understand. It’s important to realize though only shares that are voted will be counted; votes which are not voted will be ignored.

Realm’s shareholder base

So, let’s get down to business. Is it possible for minority shareholders to vote this deal down?

Let’s first take a look at the major shareholders in Realm and how some of them have already announced they will vote in next month’s shareholders meeting.

Large shareholders in favour:

As you can see, several large shareholders have already pledged their support to this deal. Together, they own 51.34% of the vote. The Realm board members, who together own 0.49% of the vote, will also vote in favour. Why? Because some of them have conflicting interests.

BVF Partners

The big winner of Realm being acquired by ESSA Pharma would without a doubt be biotech-investor BVF Partners. Apart from owning a sizable stake in Realm, BVF also owns a 9.2% stake (plus another 7.5% in warrants) in ESSA Pharma.

And ESSA Pharma has a huge problem: a lack of cash. Its lead candidate, EPI-7386 to help patients with advanced prostate cancer, has not even entered clinical trials yet and will require tens of millions of dollars of investments over the next number of years to bring it even remotely close to FDA approval. As of March 31st, the company had about 8.6 million dollars in cash, which should last ESSA Pharma until maybe early 2020 at the very latest, just as it expects to initiate costly clinical trials.

ESSA Pharma has been around for a while, in 2017, it abandoned another lead candidate after a Phase 1 study and has gone through several financing rounds already. Typically, as in most biotech offerings, shares were issued at a significant discount to the share price, with additional warrants thrown in as sweeteners diluting existing shareholders even further.

And then, Realm Therapeutics came along, with its board agreeing to a deal that in effect means Realm shareholders are paying not a discount, but over a 30% premium to the current share price for ESSA stock in what essentially resembles a traditional offering (ESSA issues stock in exchange for cash). A godsend for ESSA Pharma and its shareholders.

ESSA Pharma will eventually most definitely need even more cash, as it is many years away from generating any sort of revenue, if ever. But for now, if Realm shareholders approve this deal, the company is able to keep the lights on for a while longer. With ESSA’s cash problems out of the way, for the time being, BVF’s investment has been secured.

Orbimed

The motives of the other large shareholder of Realm, Orbimed, to back this deal are a bit more clouded. In the grand scheme of things, Realm and ESSA Pharma are just pocket change to a biotech investing giant like Orbimed, which has billions of dollars under management. As far as I know, Orbimed currently has no stake in ESSA Pharma.

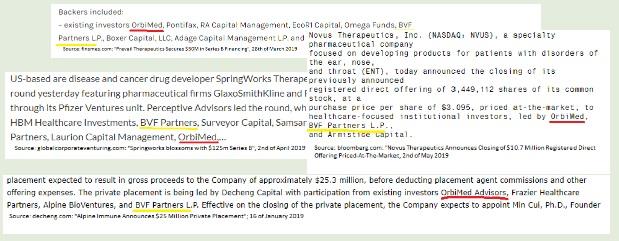

Then, yet again, the world of biotech-investment funds is a small world. BVF and Orbimed (and also Omega Funds, which happens to own 17% of ESSA Pharma) co-invest in biotech ventures on a very regular basis.

In 2019 alone, they participated together in tens of millions of dollars of financing deals:

The Board

And finally, Realm’s board. Why are they ignoring their fiduciary duty to support a deal which is so clearly not in the interests of the minority shareholders?

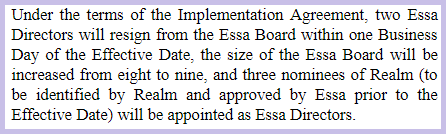

One can only speculate. It could be because three of them will have landed themselves a new job as a director at ESSA Pharma once the transaction closes:

If Realm were to maximize shareholder value by liquidating, there would obviously be no director job waiting.

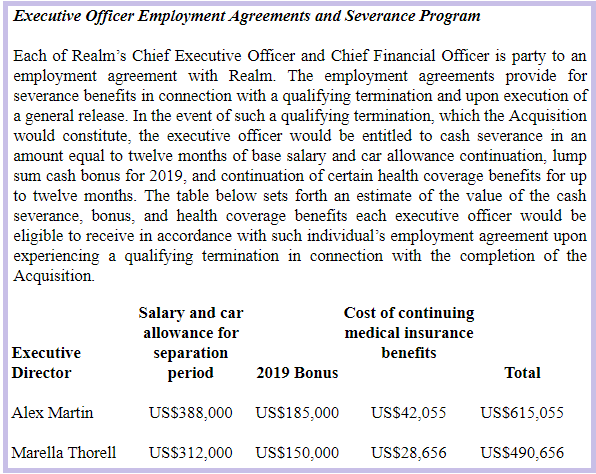

Or, it could be because the closing of the ESSA transaction would provide two of Realm’s executive directors with over 1 million dollars in combined severance benefits:

Large shareholder opposed:

Fortunately, there is also one large shareholder publicly opposing the ESSA-takeover: German-based BAVARIA Industries Group. Bavaria owns 5.96% of the vote. Daniel Sims, portfolio manager at Bavaria, has his own blog, on which he wrote about Realm in March and then again last Wednesday.

In his latest post, Sims has copied word-by-word two letters Bavaria has recently send to the board of Realm Therapeutics.

A few quotes:

The purpose of this letter is to express our extreme displeasure regarding the announcement made on May 16, 2019 that Realm is proposing to be acquired by ESSA Pharma Inc. (“ESSA”). This transaction highlights to us that the Board of Directors is beholden to a large US institutional investor with material conflicts of interest; and is at serious risk of breaching their fiduciary duties.”

The only logic we can see for this transaction is that BVF Partners needed a patsy to bail out another failed venture and so decided to leverage their significant stake in Realm and take advantage of a Board with zero skin in the game, to the detriment of every other shareholder.”

Bavaria insists the ESSA-transaction should either be restructured to include an option for shareholders to receive cash instead of shares or canceled with all cash distributed to shareholders.

Bavaria also writes:

We wish to resolve this as amicably and promptly as possible. However, we have substantial resources at our disposal and our primary business is in complex restructurings, so we are well versed in vigorously defending our shareholder rights.”

A mysterious after-hours block trade

Bavaria rightfully insists every Realm shareholder should be offered the option of cash, instead of stock. It seems one large Realm shareholder was in fact offered cash, just not the rest of us.

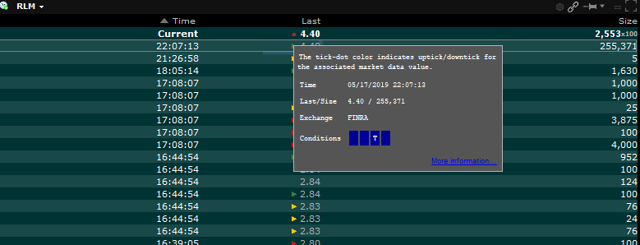

On Friday the 17th of May at 16:07:13 EST, regular US trading had just ended, an interesting transaction in Realm stock took place. 255.371 ADSs were traded off-exchange in one transaction at a price of $4.40 per share, 57%(!) over Realm’s closing price seven minutes earlier. This one transaction was over ten times the trading volume of the entire preceding trading day.

Source: Interactive Brokers, Time & Sales GMT+1

So, what might have happened here?

– As of the 31st of March, Abingworth, a UK-based bio-investment firm, owned255.371 ADSs of Realm, effectively a 5.48% stake.

– On the 17th of May, exactly 255.371 ADSs were traded in one block-trade at $4.40.

– As of the 28th of May, Abingworth was all of a sudden no longer listed as a shareholder holding an interest in excess of 3%.

– As of the 28th of May, BVF Partners owned 296.870 ADSs more than they did in February.

– $4.40 happens to be the exact cash value per ADS Realm expects to hold at the date of closing.

This is strong evidence suggesting Abingworth, like the rest of us, perhaps wasn’t too keen on seeing its holdings in Realm converted into illiquid stock at a steep discount. To prevent any trouble, it seems BVF Partners apparently offered to buy them out.

So, while Abingworth seems to have walked away from this at full cash value, the rest of us shareholders are left with a deal that devaluates our holdings to only a small part of the $4.40 that was offered to Abingworth.

If BVF Partners apparently thinks $4.40 per Realm ADS is a fair price, I strongly encourage them to make that same offer to every Realm shareholder.

Conclusion

Perhaps most disappointing in this saga is the behavior of both Realm’s major shareholders as well as the Realm board. Supporting this deal shows a blatant disregard to the small minority shareholder. Apparently, based on the assumption, this is stupid money, or, alternatively, that we are too weak and divided to do anything about it, a horrendous deal gets pushed and sold to us as if it’s “at an attractive price”, “fair and reasonable”, and “in the best interests of the Realm Shareholders” (all direct quotes from the proxy).

At the same time, it appears a larger shareholder has been offered a golden parachute out of this mess, while the rest of us have been left behind. Everything about it clearly stinks and I believe minority shareholders should fight this cash grab with all they’ve got.

Realm’s shareholders meeting is planned for the 24th of June, but ADS holders will not be allowed to attend. In the run-up to the meeting, Realm will host a conference call on the 11th of June.

The record date for who was entitled to vote was set for the 30th of May. Any shareholder that owned shares on the 29th will be allowed to vote. I strongly urge every shareholder to exercise this right. Your broker should send you voting instructions in due course; if not, contact your broker.

The vote is, in my opinion, not yet a done deal. While challenging, I believe it could still be swayed if shareholders unite. With a threshold of 75% of the vote, little over 50% voted in favor, 6% against, and several larger shareholders who have not yet indicated their voting preference, anything is still possible.

I personally can’t think of any possible scenario in which any sane-minded minority shareholder without conflicting interests would want to back this deal, and there’s a large percentage of the minority vote still out there. The biggest challenge will be to get everybody to actually vote. I strongly encourage other shareholders to reach out as much as they can through social media, blogs, bulletin boards, whatever you can think of.

You would most likely be doing your own investment portfolio a favor. With Realm currently trading at a 30% discount to cash, voting this deal down (and showing the board minority shareholders will block any attempt to do anything but cash them out at fair value) should boost the share price of Realm much closer to net cash.

It’s important to realize with a market capitalization of approximately 14 million dollars, it doesn’t take that much money to own a stake in Realm that could sway the vote. You, even if you’re a small retail investor, might own a more sizable chunk of this company than you may think. That’s why, whatever you do, vote your shares!