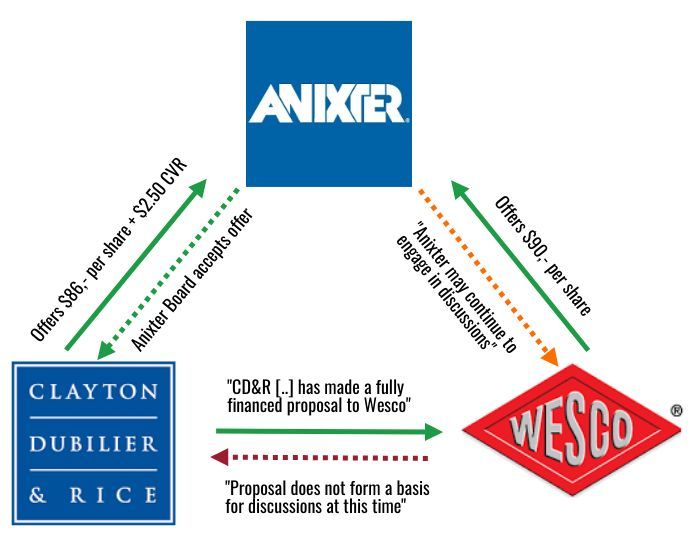

The Boards of both Anixter (NYSE: AXE) and Wesco (NYSE: WCC) won’t have time to celebrate Christmas at home this year. A bidding war to buy Anixter, a distributor of communication and security products, ensued on Christmas Eve when Wesco confirmed it had offered to buy competitor Anixter for $ 90 per share.

This announcement came after private equity firm Clayton, Dubilier & Rice (CD&R) had bumped its own previous bid for Anixter from $82.50 per share to $86 per share the evening before. In a surprising twist, CD&R also included a Contingent Value Right of $2.50 per share in its offer if the firm either managed to buy Wesco or sell Anixter to Wesco within a year of closing.

To top things off, it was also disclosed CD&R had already approached Wesco with its own buyout offer but had gotten rebuffed thus far.

The current situation can be summarized in the chart below:

“Party A”

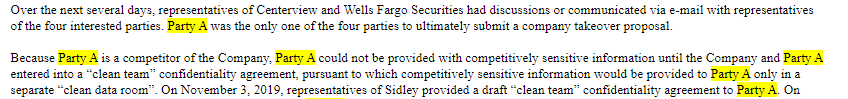

Wesco did not disclose any specifics about its $90 offer in Tuesday’s announcement but promised to further comment shortly. Most likely we already know most of the specifics though. Anixter filed a proxy statement early December revealing in great detail how it had received multiple bids from a mysterious “Party A”.

“Party A” is described in the proxy as a publicly-listed competitor of Anixter. We now know it must beyond any doubt be Wesco.

Party A (a.k.a. Wesco) came into the picture as part of the “go-shop period” Anixter undertook when it initially agreed to be bought by CD&R. The go-shop is a common provision in a merger agreement that allows the target company to seek a superior proposal from another bidder for its shareholders for a specified period of time.

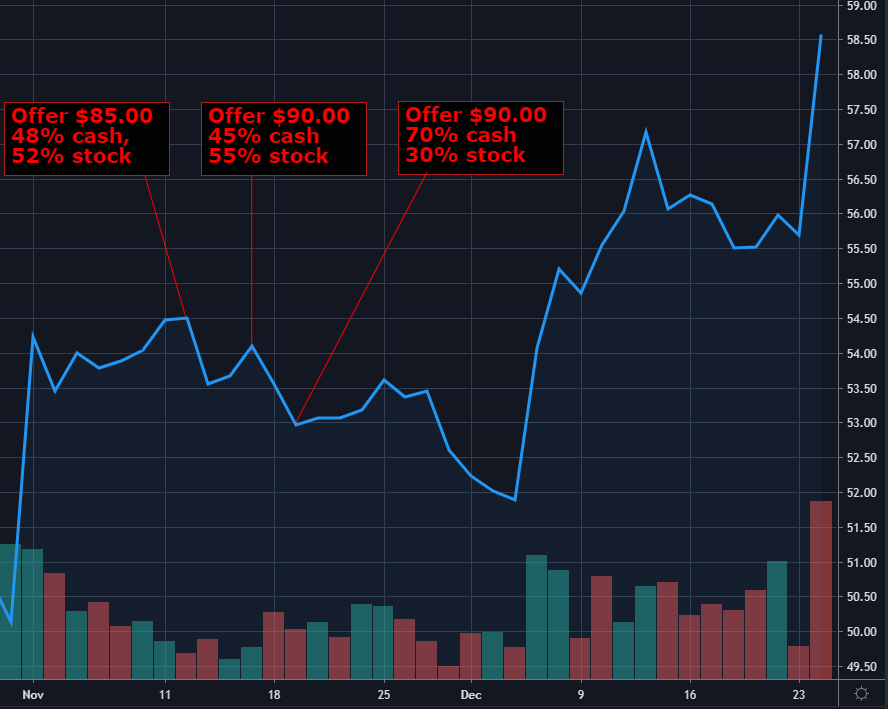

During the go-shop period, Wesco made three separate takeover proposals for Anixter. Initially, on the 12th of November, it offered $85 per share (48% cash, 52% stock). On the 16th of November, it raised its offer to $90 per share (45% cash, 55% stock). Finally, on the 19th of November Wesco improved on the terms of its $90 bid, by offering 70% cash and 30% stock.

At the time Wesco made these offers, its own stock was trading in the $53 – $54.50 range. Fueled by the news that Wesco might be a takeover target itself, the stock closed on Tuesday at $58.50.

In effect, the value of Wesco’s bid, and particularly the stock component of the bid, must have increased about three dollars on the back of its own stock soaring alone. In other words, it wouldn’t take much for Wesco to bump its bid at this stage. Simply offering the same amount of stock as it did a month ago would go a long way.

So what now?

Wesco will definitely need to improve on its offer to win this bidding war because the Anixter Board had its doubts about Wesco’s $90 offer even in November.

The Board considered Wesco’s offer contained “significant risks”, including possible antitrust-issues that might delay a transaction from taking place. Also, Anixter emphasized the risks related to the stock component in Wesco’s bid (which requires approval by Wesco’s shareholders), compared to CD&R’s straight forward all-cash offer.

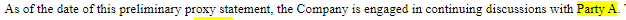

But Anixter also writes:

In other words, Wesco’s offer was close to convincing the Anixter Board, but not (yet) close enough.

Then this week CD&R raises its bid, seemingly out of the blue. Anixter graciously accepts, but even then still doesn’t quite shut the door on Wesco:

In response, Wesco immediately decides to publicly emerge as “Party A”. If Wesco wasn’t willing to follow through on its interest in Anixter, why come forward at all? They know their $90 bid wasn’t going to win even before CD&R raised its own offer.

Also, if Wesco wants to remain in control of its own destiny, does it really have a choice but to raise its offer? It now explicitly knows if CD&R succeeds in buying Anixter, Wesco, which in terms of market cap is smaller than Anixter, will be its next prey.

The fact that Wesco came forward signals to me there’s at the very least intent (and, because of Wesco stock going up so much, a possibility) to raise their own offer to a level where Anixter’s Board has no choice but to consider it superior to CD&R’s offer.

Conclusion

Based on these assumptions I estimate the chance of Wesco raising its bid to at least $94 per Anixter share over the coming weeks at 50/50 at the very minimum.

With Anixter currently trading at around the $90 mark, and downside capped to CD&R’s $86 offer, plus whatever you think the $2.50 CVR is worth, I believe there’s a favorable risk/ reward to maintain an Anixter long position while waiting for future developments to unfold.

Update (26/12/2019):

Today after-hours Wesco announced it has improved its bid for Anixter to $93.50 per share. The offer consists of 63$ in cash, 0.2397 of WESCO stock and $16.65 of a new to be created class of listed Wesco Preferred stock. Read more here: wesco.investorroom.com/…