After the trading session on the 9th of January trading in shares of Novelion Therapeutics (PINK: NVLNF) will likely be suspended indefinitely. If the company’s liquidation plan is approved by the Court of British Columbia this once sizable drug company will delist. Eventually, it will cease to exist, but not before distributing its remaining assets to its shareholders.

And, after taking into account liquidation cost (which the company has already put aside), those remaining assets will likely not consist of any cash, but of 12.5 million shares in UK-listed Amryt Pharma (LON: AMYT). Amryt is currently trading at GBP 1.22 per share, which makes Novelion’s stake worth about 15 million British Pounds, or 19.75 million US Dollars. This equals approximately $1.00 per Novelion share.

With Novelion currently trading at $0.75, that’s a 25% discount. However, this isn’t your average liquidation play. Proceeds are uncertain as fluctuations in Amryt’s illiquid share price will affect the value of any distributions. With Novelion delisting soon, you are basically locking up your money, as the liquidation distribution isn’t expected to take place until late this year. The Amryt share price might go down in the meantime, eliminating any spread.

So with three days of trading in Novelion shares to go, in this article I’ll take a last-minute, closer look at Amryt, and whether this opportunity to invest at a discount is worth pursuing.

Amryt Pharma

Last year Novelion had only one operating subsidiary, named Aegerion Pharmaceuticals. Aegerion owns two FDA approved drugs, Myalepta and Lojuxta. Aegerion filed for a pre-negotiated bankruptcy in May of 2019.

From my reading of the financials, the biggest problem of Aegerion was its excessive debt load of 440 million dollars, coupled with lackluster growth numbers for its drugs. Also, it has a checkered past because of a run-in (now settled) with the US Justice Department with regards to the marketing of one of its drugs.

In September of 2019 in a complex recapitalization operation, Amryt, which is an orphan disease drug company, lifted Aegerion out of bankruptcy by completing its acquisition. Amryt was already selling Aegerion’s drug Lojuxta under license in Europe, as well as developing its own drugs (AP101, for wound treatment for patients with Epidermolysis Bullosa, and pre-clinical AP103). In contrast to an earlier (but unsuccessful) attempt by Novelion itself, Amryt has been quite successful marketing Lojuxta in Europe.

Debt was partly converted into equity at a valuation of the combined Amryt/Aegerion of 310 million dollars, partly into warrants and partly into 5-year convertible notes with a conversion price 20% above that valuation.

An additional 60 million dollar fundraise, which was fully back-stopped by some of the debt-holders with fresh capital, was also completed at that same 310M valuation mark. As a reminder, these are valuations well above the approximately 250 million dollars Amryt is currently worth.

The recapitalization operation has been completed, and a new entity has emerged with a decent amount of cash on hand, and a significantly lower debt-load.

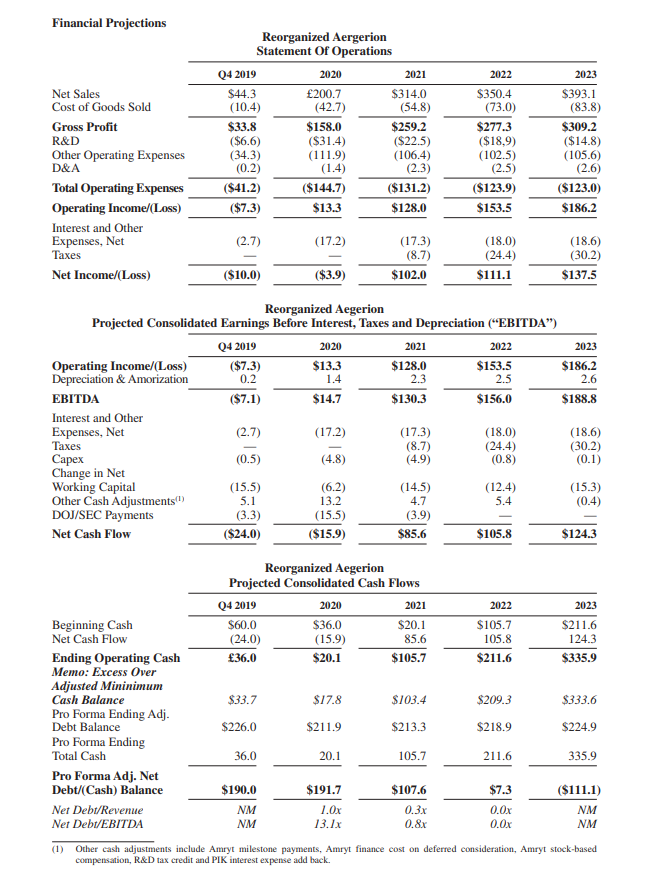

I’ve included an attachment that shows a table with financial projections from the debtors for the “new Aegerion” for the next few years which were published during the bankruptcy proceedings of Aegerion in September. It shows a company that is well-capitalized and aggressively growing revenues, nearly breaking even in 2020 and being (very) profitable after that.

Honestly, these estimates look extremely(!) aggressive. Based on these figures Amryt is currently trading at a Price/Earnings-ratio for 2021 you can count on the fingers of one hand, based on a fully diluted share count, including conversions from warrants, as well as convertible debt at prices about 40% over the current Amryt share price. Sounds too good to be true? It probably is.

These projections weren’t made by Amryt management themselves, but by the debtors in the Aegerion bankruptcy. They served to convince the US Bankruptcy Court to approve the reorganization, not to necessarily attract investors. Amryt went out of their way in September to emphasize they take no responsibility for its projections. It’s therefore important not to put too much weight on them.

But even if Amryt performs well enough, but does not meet these “back of an envelope” financial projections laid out by the debtors by a considerable margin (very likely), it still looks quite cheap.

Also, since the “new” Amryt emerged out of restructuring, trading updates from the company have been particularly upbeat. In October Amryt reported a 19.7% pro forma revenue growth, to 113 million dollars over the first nine months of 2019.

Then later, on the 19th of December Amryt reported a cash position of 60.9 million dollars (“significantly ahead of expectations”), which suggests virtually no cash burn since the restructuring was completed in September. Those numbers are even somewhat ahead of the projections laid out by the debtors during bankruptcy.

2020

When back-tracking to the Novelion investment case, we are mostly interested in what Amryt will do in 2020. After all, after this, the Novelion liqudation will be completed.

And Amryt is very confident for 2020. When I asked, the company confirmed they are aiming to be cash EBITDA positive for the year. Considering the healthy cash position, they believe they have sufficient cash to get the company to that stage.

And 2020 will be a very important year for Amryt. It will have to show investors it’s able to do a far better job selling Myalepta and Lojuxta in the US, but especially in Europe (and the Middle East) than Aegerion ever did. It’s quite obvious where growth is supposed to be coming from. Myalepta was approved in Europe only in late 2018 (with a wider label than in the US), and was still in the process of being launched in 2019. Increasing the number of markets should drive growth. Also, Amryt is actively undertaking additional studies aiming at expanding the number of indications for both Myalepta and Lojuxta over the coming years, especially in the US.

Finally, somewhere mid 2020, Amryt will announce Phase 3 topline data for its own lead development drug AP101. Last year Amryt, based on an interim efficacy analysis, was asked by the IDMC to expand the number of patients in this study to maintain statistical power. This suggests the drug isn’t a total bust (in which case the study would have been terminated) or a slam-dunk for that matter, but could require a moderately larger sample size to confirm success or failure.

Although the upside of a good (or bad) readout is capped somewhat by 85 million dollar worth of Contingent Value Rights (dependent on FDA- and EMA-approval and a revenue milestone), which were issued to Amryt investors previously, it could still act as a catalyst for its share price.

US listing

To be able to hedge exposure against the Amryt Pharma share price, investors might not need to wait for the liquidation process of Novelion to be fully completed. Amryt has announced it is seeking a Nasdaq listing, besides its UK (and Euronext Growth) listing. With a Nasdaq listing, it seems likely a reliable short borrow will become available, which (depending on the borrow fees) would allow an investor to capitalize on the spread. There’s currently virtually no borrow available in the UK market.

Orginally Amryt planned for a Nasdaq listing in 2019. This didn’t happen. When I asked Amryt about this they confirmed they are still seeking a listing, but weren’t able to specify a time-frame.

In the meantime, it will become possible to trade Amryt shares in the US very soon. A Citibank sponsored ADR has more or less started trading under ticker AMRYY. One ADR equals five ordinary shares. There has been virtually no trading so far, as the ticker is not yet cleared for trading with most brokers (at least not with the ones I tried). That should soon change.

Conclusion

I have been closely following Amryt since September 2019 when it acquired Aegerion. After doing a number of special situation trades in September when Amryt issued sizable Contingent Value Rights related to the success of AP101 (which the market basically failed to notice and gave away for free), the company has remained on my watch list.

While investing in biotech, especially in orphan diseases, one needs to be a medical specialist to be able to fully understand market potential. I would like to emphasize I’m not one of those. My style of investing isn’t about deep analysis of one particular company, but about (more superficial) special situation investing. I often invest (or decide not to invest) based on a broad picture.

With that in mind so far I like what the “new” Amryt seems to offer: a possible turn-around scenario in two already approved and established drugs with new, enthusiastic (very well incentivized) management. On top of that, possible additional upside with a new drug very close to its Phase 3 conclusion, and what seems to be a cheap valuation. Also, a group of debtors who were willing to backstop a financing round at prices over 20% the current Amryt share price, and a healthy cash position which should guarantee no dilutive upcoming financing rounds in the coming years.

Because I’m optimistic about Amryt, I like Novelion, trading at a 25% discount (down from a 40% discount some months ago), even better. There is obvious risk, but I don’t mind a bit of risk when I stake conservatively and feel the odds are in my favor. I feel confident the Amryt share price will hold up over an extended period, so I’ll eventually be able to capitalize (and hopefully some more) on the current spread between Novelion and Amryt.

Update 9th of January: Novelion’s delisting has been pushed back one week to the 16th of January.