MGTSummary

- Last Friday MGT Capital filed its long awaited proxy statement with details on the proposed appointment of John McAfee as its new CEO.

- Proposals with regards to recent acquisitions as well as a stock option plan for McAfee himself would, upon approval, severely dilute existing shareholders.

- MGT also proposes to sharply increase the number of authorized shares, suggesting even more dilution is just around the corner.

- Even MGT’s bull case does not look like good news for shareholders at this point.

Introduction:

A lot has been written about MGT Capital (NYSEMKT:MGT) those last couple of weeks. Ever since the company announced in May of this year it wanted to transform itself into a cybersecurity company led by the infamous John McAfee, who rose to world fame after founding and later selling his stake in anti-virus pioneer McAfee Associates, the stock price has been moving up.

So far, there had been a lot of hype and very little facts surrounding this transformation. That all changed when MGT released its preliminary proxy statement very late last Friday.

The proxy statement is a document that is published in preparation of a MGT shareholders meeting which will be held sometime in August. Here shareholders will be asked to approve a series of proposals, some in relation to previously announced acquisitions, some in relation to the capital structure of MGT Capital (which, if approved, will be renamed to John McAfee Global Technologies), and some in relation to the appointment and remuneration of, among others, John McAfee himself.

I’ve written this article to summarize the most important proposals in the proxy statement, as well as to analyze its implications on current shareholders. Furthermore, I’ll use the proxy statement to build a bull and a bear case on the future of MGT and I’ll argue why I believe either case will eventually wipe out current MGT shareholders.

1. The acquisition of D-Vasive and Demonsaw

The first shareholder proposal I’ll address in this article relates to the previously announced acquisitions (1 2) of the assets of both D-Vasive and Demonsaw (Shareholder proposal #3). D-Vasive is a developer of a privacy and anti-spy app available on, among others, Google Play. Demonsawdevelops a (free) anonymous information-sharing application.

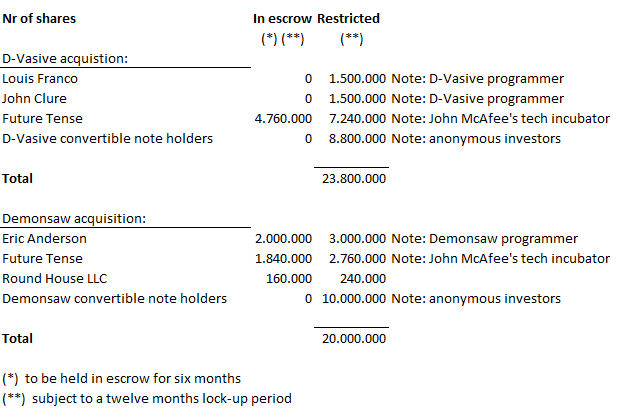

MGT is paying 23.8 million shares (plus 300,000 dollar in cash) to acquire the D-Vasive assets, and 20 million shares to buy the Demonsaw assets. That’s a combined 43.8 million shares, while MGT itself currently has “only” 26 million shares outstanding. At current market prices the acquisition of D-Vasive and Demonsaw combined is worth an impressive 185 million dollar.

The table below shows who will receive how many shares in MGT if the deal is approved. It’s interesting to note Future Tense Central is a selling party in both transactions; Future Tense Central is a technology incubator founded by none other than MGT’s soon-to-be CEO John McAfee.

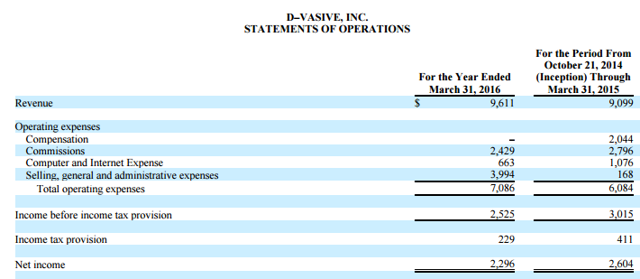

So what has MGT bought exactly? The proxy statement contains a full set of financials for D-Vasive. Let’s take a look:

You’re reading that right: MGT is paying 23.8 million shares for a company that did 9,611 dollar in sales over fiscal year 2015, and generated 2,296 dollar in net income (actually down from a five-month period the year before).

Because of the way the asset purchase was structured, the proxy statement did not include any financial specifics on Demonsaw. As its application is free, it quite likely generates no revenue at all though.

2. Increase of authorized shares / Reverse split

The proxy statement also contains a proposal by MGT with regards to an increase of authorized shares (Shareholder proposal #5) from 75 million to 250 million shares, as well as a proposal to extend the term for a previously approved reverse split (Shareholder proposal #6) in a ratio of no less than 1-for-2.

Both proposals essentially serve the same purpose: a company is only allowed to issue shares up to a maximum number approved by shareholders. A reverse split decreases the number of shares outstanding by a certain factor, while the number of authorized shares remains constant, creating room to issue new shares. An increase of the number of authorized shares increases the limits of issuing more shares directly.

The proposal with regards to the reverse split isn’t news in itself. When the MGT share price was hovering around $ 0.30 earlier this year, a reverse split seemed like a logical way to stay compliant to exchange regulations and shareholders had already approved it in an earlier stage. This year though, the MGT share price is up roughly 1300%, which might have given investors confidence a reverse split would no longer be necessary.

Overall, what appears to be most negative for existing shareholders are both proposals in conjunction to each other. It signals a firm commitment from McAfee he intends to fund MGT’s future by aggressively issuing new shares.

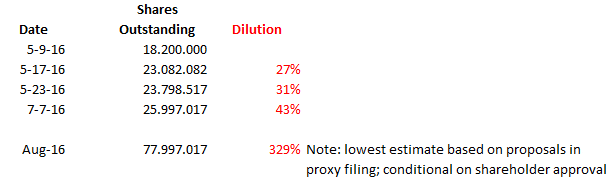

For those that have been paying attention to the MGT share count those last weeks this comes as no surprise. Since announcing its new plans in May MGT has quietly diluted its shareholders by over 40% already. Various other proposals in the proxy statement (the acquisitions described above, and the stock option plan described below) will, upon shareholders approval, dilute shareholders yet another 200%.

A reverse split in conjunction with an increase in the number of authorized shares clearly signals it doesn’t end there. Approval of both proposals would make it possible for MGT management, if they choose to do so, to dilute a further 600% on top of any previous dilution, before shareholders would ever need to be consulted again.

3. Appointment and employment agreement of McAfee and Ladd

MGT shareholders will be asked at the Meeting of Stockholders in August to appoint John McAfee as its new CEO (Shareholder proposal #1). They will also get to vote about the level of compensation (Shareholder proposal #7) for both John McAfee, as well as Robert Ladd, the current CEO of MGT, and future COO. The proxy documents contain a copy of both employment agreements for reference.

Let’s start off with McAfee. Under the proposal McAfee will receive a symbolical base salary of $ 1 per day. His real compensation however will be entirely paid out in MGT stock options, mostly exercisable at a very steep discount to the current share price.

McAfee will receive:

- options to purchase 1,000,000 shares at the higher of $ 0.25 and the current MGT share price;

- options to purchase 2,000,000 shares at $ 0.50;

- options to purchase 3,000,000 shares at $ 1.00;

These options will vest in twenty-four equal monthly installments.

Let’s quickly do the math on this: every month McAfee will receive options to purchase over 41,000 shares at market price, over 83,000 shares at $ 0.50, and 125,000 shares at $ 1.00.

This means that, at Friday’s closing price of MGT stock of $ 4.29, McAfee’s monthly compensation would be worth a whopping 738,000 dollar a month(or 8,85 million dollar per year). Obviously, his compensation is heavily dependent on MGT’s share price. No wonder McAfee has been watching the MGT share price like a hawk, sometimes commenting on the latest stock price movements minutes after they happen per his Twitter account.

Now let’s move over to Robert Ladd’s compensation. Ladd, who has been actively selling his MGT shares since MGT announced its new business plans, will get compensated 240,000 dollar a year under the proposal. That’s not where it ends though. As an “inducement” for Ladd, the proposal also included a reward of 2,000,000 shares of MGT. These shares have a current market value of over 8,5 million dollar, and will vest between twelve and twenty-four months after the agreement is approved.

McAfee and Ladd’s proposed share compensation plans are so generous they fall outside off the scope of MGT’s previously approved 2012 Stock Incentive Plan. Therefore, MGT shareholders are also asked to approve a new 2016 stock option plan (Shareholder proposal #4). This plan would allow for, not only issuing 8 million options to McAfee and Ladd combined (see above), but also another 10(!) million options for “directors, officers, employees, consultants and advisors” to be awarded “at the sole discretion” of the Board of Directors.

Questions the proxy statement doesn’t answer

Despite MGT’s proxy statement being one-hundred pages long, there’s also anumber of questions it doesn’t answer. For example, it doesn’t address how MGT thinks it will generate the much needed cash to finance its new operations. If MGT is serious about its ambitions, a very significant (further dilutive) equity financing deal seems unavoidable within months, if not weeks, after shareholder approval.

Mystery also surrounds events taking place at D-Vasive days before MGT announced its plans to acquire the D-Vasive assets. An SEC-filing tells us D-Vasive issued $100,000 worth of Convertible Notes to sixteen unidentified accredited investors on the 5th of May. These Notes, upon conversion, would convert in what appears to be an, at that time, 47% stake in the company. This would implicitly value D-Vasive at little over 200,000 dollar.

A mere four days later, MGT announced it planned to buy the D-Vasive assets suddenly valuing the entire company at over 10,3 million dollar (based on the MGT market price at the time; that same deal is now valued at close to 100 million dollar!). The sixteen investors made an absolute fortune on paper overnight, and will walk away with 8,8 million shares of MGT (which are currently worth about 38 million dollar), if shareholders approve of course. But why did D-Vasive need to take out a convertible note four days(!) before all of its assets were acquired? And who exactly are those mystery investors about to make millions? The proxy statement does briefly describe the transaction taking place, but does not offer any details. That’s unfortunate, as there could have been a legitimate reason for the note, but without knowing more it looks like a select group of investors could have been given a free ride at the expense of MGT shareholders.

A similar storyline could very well have transpired with regards to the Demonsaw-acquisition. Demonsaw had similar outstanding mystery Convertible Notes on its books when it was acquired. Upon shareholder approval these Notes are about to exchanged for 10 million shares of MGT (currently worth 43 million dollar!).

Two scenarios

Seeking Alpha encourages all of its authors to present both a bear case, as well as a bull case in its articles. So here goes:

The Bear Case:

A bear might argue MGT is foremost and above everything else a scheme designed to print new shares to insiders, who then sell them in the market at inflated prices.

Upon shareholder approval, the company will be buying assets (D-Vasive and Demonsaw) that generate no revenue to speak of, at ridiculously inflated prices. In both deals, John McAfee had, at the very least, a potential conflict of interest: he was both the likely future CEO of the company buying the assets, as well as the founder of the shareholder of the company that was selling.

MGT is lavishly rewarding its upper management with millions of dollars in stock and stock options at the expense of existing shareholders. And on top of this MGT’s business strategy is murky at best: it goes from buying an anti-spy app, to buying an anonymous information sharing application to planning tobecome a Bitcoin miner within weeks. MGT chews out press releases with a lot of hype like there’s no tomorrow, but these releases generally lack substance. Appointing (1 2 3 4 5) an ever growing number of people to Advisory Boards might look impressive, but above all costs money. What those Boards are supposed to advise on remains a complete mystery as the company doesn’t appear to be doing all that much, except for its soon-to-be CEO who spends most of his days tweeting to investors.

All in all, a bear might argue MGT looks very much like an extended “pump-and-dump”. It might very well never create any marketable product in the first place. Regardless, 71-year old McAfee, whose net worth presumably exceeded100 million dollar at one point, but who in 2012 told reporters he was “broke”, likely doesn’t need to worry about his retirement anymore. McAfee is raking in millions of shares of MGT by selling assets to MGT through his tech incubator Future Tense Central, while at the same time raking in millions of shares as part of his tenure as CEO of MGT. But McAfee is not the only one making it big: outside of the spotlights, and apart from a few part-time software programmers, MGT’s pre-existing shareholders (COO Robert Ladd, ‘hedgie’ Joshua Silverman, as well as renowned micro-cap financiers Barry Honig and Michael Brauser, who’ve been named – 1 2 3 – in several Seeking Alpha short reports in the past), and a number of anonymous investors in D-Vasive’s convertible loan-mystery are, among others, all striking it rich thanks to McAfee.

In between promises not being kept, and insiders inevitably unloading their shares in the open market, other shareholders will at some point stop believing. Eventually, a bear might argue, this will drive the MGT share price into the ground.

The Bull Case:

A bull might argue John McAfee is seriously trying to build a cybersecurity company. It’s only natural for upper management to be paid millions in share-based compensation, as it aligns management and shareholders’ interests. On top of this, recent appointments of industry insiders to MGT Advisory Boards indicate others are taking McAfee’s ambitions very seriously.

One could say that paying 43 million shares for assets that (despite being available for free before) have never gained any traction in the marketplace, generate virtually no revenues and seem to offer little cohesion to each other, might seem excessive on the surface, but that it’s the technology that counts and not the financials (or lack thereof). This is all part of a much bigger plan to build one big enterprise-focused product, instead of a focus on the consumer market. Rome wasn’t build in a day after all: future acquisitions, integration of different technologies (for example, integrating D-Vasive with a mobile tracking device technology MGT will be allowed to commercialize) and continuous development will fill in the blank spots into creating a product that primarily targets large corporations and governments. At this point shareholders simply need to be patient before the first large contracts will come in.

But, then again, let’s take a step back for one minute. Even if one were to follow this train of thought, there’s one problem. Future acquisitions, developing new software, paying for upper management, paying for Advisory Board Members, eventually marketing efforts, all cost money, and lots of it. And MGT has very little of that.

Whether you pay your way in cash (generated by equity financing), or directly in stock, doesn’t ultimately matter all that much. To get MGT to where it wants to be, it will seriously have to dilute shareholders before any serious revenue will ever be realized. MGT already diluted shareholders over 40% in two months, and the proposed acquisitions and board compensation up for shareholder approval will dilute existing shareholders yet another 200%. And in any scenario imaginable this is only the beginning. When taking McAfee’s own ambitions, as well as the content of Friday’s proxy (especially the large increase of authorized shares) at face value, as bulls surely do, the printing press is just beginning to warm up. Dilution will go on and on and on before McAfee ever comes close to realizing the cybersecurity giant he has been dreaming about. By that time, McAfee might have succeeded, but today’s shareholders will likely have long been wiped out.

Conclusion

In this article I’ve summarized and explained the most important (and remarkable) aspect of the proxy documents filed by MGT last Friday night. Despite some of the proposals being negative for current shareholders, it seems unlikely any of the proposals will not be approved.

I’ve argued in this article that whether MGT is simply a vehicle to issue and sell new shares out of thin air to enrich a select group of individuals (the bear case), or a serious attempt to create a company in the cybersecurity space (the bull case), doesn’t ultimately matter all that much. In both scenarios dilution will wipe existing shareholders out.

What’s now still a stream of new shares trickling down to the market place (40% dilution in two months), will over the next months and years turn into a tsunami of new shares as lock-ups expire, restricted shares become unrestricted, financing deals are closed, and option plans vest.

Including the currently 26 million shares outstanding, 44 million shares to be issued for acquisitions, and 8 million shares in director compensations, MGT now already has a market cap of roughly 330 million dollar. Bull or bear, in my opinion that market cap is beyond reason. It’s not something the people trading MGT will likely want to hear, but in the long term, as hype dies out and facts take over, fundamentals do actually matter. And in any scenario fundamentally the only way this stock can possibly go is (a very long way) down.

I am currently short MGT through an owned entity. With an excessive short borrow rate, shorting MGT isn’t a slam-dunk proposition though. Timing your trades is very important.

Disclosure: I am/we are short MGT.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.